If you’re eager to test out Trading 212, using a referral is one of the smartest ways to begin. New users who sign up via this link:

👉 Join Trading 212 with this Trading 212 referral

—or enter the code FMStoXkl can receive a free share, worth between £5 and £100, after making an initial deposit of at least £1.

Trading 212 UK: Unlocking Commission-Free Investing & Smart Tools

1. Introduction: What is Trading 212?

Trading 212 is one of the UK’s most popular investment platforms, giving over 4.5 million users access to global stock markets. Founded in 2004 and headquartered in London, it has grown into a fintech leader offering commission-free investing, multi-currency accounts, and tax-efficient ISAs.

It’s regulated by the FCA in the UK, with client funds protected under the FSCS up to £85,000, and offers additional insurance via Lloyd’s of London. For retail investors, Trading 212 combines low-cost access with user-friendly technology.

And thanks to the Trading212 referral scheme, new users can start investing with a free share worth up to £100.

👉 Join Trading212 here using referral code FMStoXkl to claim your reward.

2. Account Types & Product Suite

Trading 212 Account Types & Product Suite

1. Invest Account (GIA)

- What it is: A regular brokerage (General Investing Account), sometimes simply called “Invest.”

- Features:

- Commission-free trading of stocks and ETFs — own actual shares, including fractional amounts (£1 minimum).

- Access to thousands of global markets and assets.

- Multi-currency support (GBP, EUR, USD, etc.), enabling FX-free trading in respective currencies.

- Earn daily interest on uninvested cash, up to around 4.9% AER.

- No minimum deposit; standard cards and bank transfers accepted.

- Commission-free, but currency conversion charges of 0.15% may apply.

2. Stocks & Shares ISA

- What it is: A tax-efficient wrapper for your investments.

- Features:

- Tax-free growth on capital gains and dividends.

- Annual contribution limit of £20,000 (2025 tax year).

- Same commission-free trading, fractional shares, multi-currency features as the Invest account.

- Borrow interest on cash held: e.g., 4.35% AER within the ISA.

- Flexible; withdrawals can be replaced within the same tax year if applicable.

3. Cash ISA

- What it is: A savings-focused, tax-free account for cash (not investments).

- Features:

- Offers ~4.1% AER interest on uninvested cash, paid daily.

- No platform or admin fees.

- Complete flexibility with withdrawals; funds can be replaced without using up ISA allowance.

- Ideal if you simply want tax-free savings, not exposure to markets.

4. CFD Account

- What it is: A margin-based trading account for contracts for difference (CFDs).

- Features:

- Leverages positions to trade forex, indices, commodities, and more — without owning the underlying asset.

- Zero commissions, but profit is made via spreads and financing costs.

- Currency conversion fee of 0.5%, plus daily overnight financing charges (“swap”).

- Requires a minimum deposit (around €10).

- High risk: 76–79% of retail CFD accounts lose money.

- Appropriate only for experienced, risk-aware traders.

Quick Comparison Table

| Account Type | Tax Treatment | Commission | Currency FX Fee | Cash Interest | Risk Level | Best For |

|---|---|---|---|---|---|---|

| Invest Account (GIA) | Taxable gains/dividends | £0 | ~0.15% | ~4.9% AER | Low-medium | Long-term, flexible investing |

| Stocks & Shares ISA | Tax-free gains/dividends | £0 | ~0.15% | ~4.35% AER | Low-medium | UK investors using full allowance |

| Cash ISA | Tax-free cash savings | — | — | ~4.1% AER | Low | Tax-free savings without market risk |

| CFD Account | Taxed (as per income) | £0 | 0.5% | None | Very High | Experienced, speculative traders |

What Users Say

On Reddit, users often steer newcomers toward Invest or ISA accounts for long-term wealth-building:

“ISA – it’s tax-free for all gains and growth… if you are new then stay away from CFD…”

“Invest account will suit you best… zero fees.”

Choosing the Right Account on Trading 212

- Use the Stocks & Shares ISA if your goal is long-term, tax-efficient investing under £20,000/year.

- Use the Invest Account (GIA) if you’re investing frequently, looking for flexibility, or exceeding ISA limits.

- Use the Cash ISA for simple, high-yield tax-free savings—no market exposure.

- Avoid the CFD Account unless you’re a sophisticated trader who understands leverage risks.!

3. Enhanced Feature Breakdown: What Makes Trading 212 Stand Out

Multi-Currency Accounts & Seamless FX

Trading 212 allows you to hold and trade in multiple currencies—like GBP, EUR, USD—without excessive conversion fees. You can buy assets directly in their native currency, while only paying a 0.15% FX fee, offering flexibility and cost-efficiency for global trading.

High Interest on Idle Cash (~4.9% AER)

Uninvested cash in your Invest or ISA account isn’t idle—it earns interest. The current variable rate stands at approximately 4.9% AER, paid daily, which beats many high-street offerings.

Pies & AutoInvest: Automate Your Portfolio

Pies let you build thematic or custom portfolios by mixing stocks/ETFs into a single investment “slice.” With AutoInvest, you can set periodic contributions—say £50 weekly—to be allocated automatically across your Pie according to your chosen proportions. Users often highlight this as a tool that simplifies disciplined investing through features like auto-saving, semi-automated rebalances, and flexible scheduling.

Fractional Shares from £1

Want to invest in expensive names like Tesla or Apple? No problem. With fractional shares, Trading 212 allows you to invest from just £1, making high-value stocks accessible to all.

Commission-Free Trading

Trading 212 operates on a zero commission model for stocks and ETFs—meaning no per-trade costs. This makes frequent trading or investing in small amounts highly affordable.

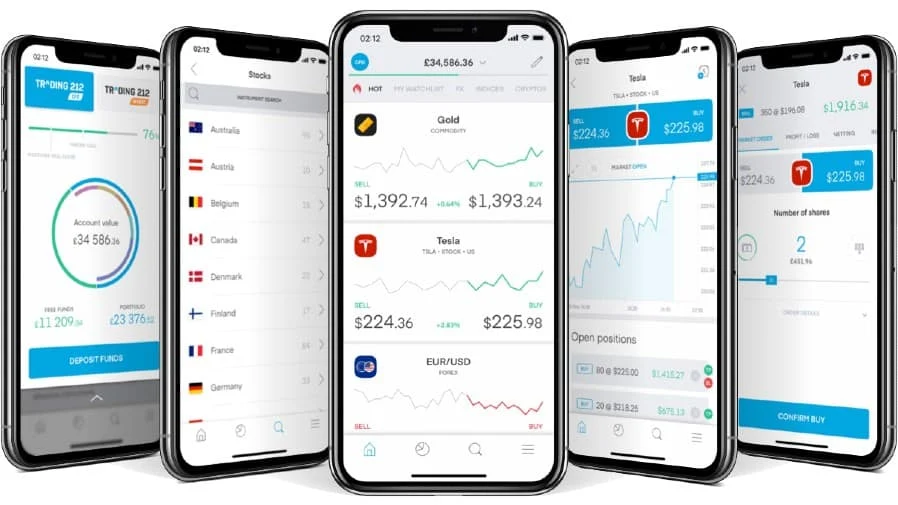

Intuitive Mobile-First Interface

Available on both mobile and web, Trading 212’s platform is clean and user-friendly. Users consistently praise its ease of use for everything from placing trades to navigating portfolio insights and account tools.

Transparent Order Types & Alerts

Trading 212 supports essential order types like Market, Limit, and OCO (One Cancels the Other), giving you control over execution. Plus, you can set price alerts to notify when markets hit your target levels.

Educational Resources for All Levels

Whether you’re a first-time investor or seasoned investor, Trading 212 includes an Investing 101 section, glossaries, and basic financial data (like balance sheets and income statements) to empower learning directly from the app.

Summary Table: Feature Comparison

| Feature | Description |

|---|---|

| Multi-Currency Accounts | Trade in multiple currencies with only 0.15% FX fee |

| High Interest on Cash | ~4.9% AER, paid daily on uninvested balances |

| Pies & AutoInvest | Build and automate thematic portfolios |

| Fractional Shares | Invest in expensive stocks from just £1 |

| Commission-Free Trading | No trading fees for stocks & ETFs |

| Intuitive Platform | Clean mobile/web interface for easy use |

| Order Types & Alerts | Support for Market, Limit, OCO orders and price alerts |

| Educational Tools | Investing guides, glossaries, and financial data |

These features make Trading 212 a compelling choice for UK investors—especially those looking for accessibility, automation, and value.

4. How The Trading 212 Referral Promotion Works

- Randomly Assigned Share: Your bonus is a randomly selected fractional share, valued between £5–£100. While the maximum is possible, most users receive a lower amount.

- Fast Reward Delivery: After verifying your identity and depositing at least £1, the free share is added to your account within three business days.

- Quick Qualification Window: The deposit must be made within 10 days of account creation to qualify.

- Flexible Use: You can sell the free share immediately, and withdraw the cash proceeds after roughly 30 days.

Step-by-Step Guide to Claim Your Free Share

- Visit the Trading 212 referral link: https://www.trading212.com/invite/FMStoXkl

- Sign up for a Trading 212 Invest or Stocks & Shares ISA account.

- Verify your identity through the app (KYC process).

- Make a minimum deposit of £1 within 10 days of signing up.

- Expect your free fractional share (valued up to £100) within 3 business days.

- You can sell the share immediately, with cash becoming withdrawable ~30 days later.

Why It’s a Smart Move

- Free value from the very start, lowering your barrier to entry.

- No strings attached—you only need to deposit £1 and invest—or not—what you like.

- Start building a portfolio, even if you’re investing minimally.

- The bonus is completely optional and enhances your experience from day one.

Summary Table

| Requirement | Details |

|---|---|

| Trading 212 Referral Link / Code | https://www.trading212.com/invite/FMStoXkl (or code FMStoXkl) |

| Minimum Deposit | £1 |

| Reward | Free fractional share (£5–£100 in value) |

| Delivery Time | Within 3 business days post-deposit |

| Qualification Window | Deposit must be within 10 days of signup |

| Sell & Withdrawal Rules | Sell immediately; withdraw proceeds after ~30 days |

Using the Trading 212 referral link or code is a seamless way to dip your toe into investing with a free bonus. Whether you’re setting up your first ISA or testing their Invest account, this offer gives you a head start.

5. Fee Structure & Costs

| Fee Type | Details |

|---|---|

| Commissions | Stock & ETF trades are commission-free. |

| Currency Conversion | 0.15% fee when converting currencies during trading. |

| Deposit / Withdrawal | Free via bank transfer, card, or Apple/Google Pay (card deposit fees may apply after thresholds). |

| Cash ISA Holding Rate | ~3.85% AER, interest paid daily. |

| CFD Trading | Fee through spreads only—not for Invest accounts. |

6. Pricing vs. Traditional Platforms & Alternatives

Trading 212 is often hailed as the most cost-effective platform for UK-based investors, with no trading fees and competitive interest on holdings—especially when compared to platforms like Halifax or Interactive Investor where fees can exceed 1%.

According to MoneyWeek’s 2025 app roundup, Trading 212 earns top marks for low-cost investing, alongside favorites like Freetrade.

Alternatives include eToro (social trading), Freetrade (simple investing), Hargreaves Lansdown, and AJ Bell—each offering a unique blend of tools, assets, and experience levels.

7. App Experience & Accessibility

- Mobile-first interface rated highly for usability and robustness (4.8/5). Includes biometric login, price alerts, diverse order types (Market, Limit, OCO).

- Accessible via mobile and web. Account setup is quick and paperless.

8. Safety & Trust

Trading 212 segregates client funds and is regulated across multiple jurisdictions. In the UK, the FSCS covers client funds up to £85,000. CySEC provides protection up to €20,000 for EU users, supplemented by private insurance up to €1 million.

9. Summary: Who Should Use Trading 212?

Best For:

- Beginner to experienced investors wanting low-cost access to global stocks and ETFs.

- Those valuing fractional investing, automated tools, and high-interest cash savings.

- UK users wanting tax-efficient investing via a Stocks & Shares ISA.

Limitations:

- No broader product range like bonds, mutual funds, or SIPPs.

- Limited advanced analytics and research tools.U

Conclusion

Trading 212 has earned its position as one of the UK’s leading fintech brokers through its transparent, commission-free model, intuitive design, and valuable investor tools. Whether you’re testing the waters with a demo account or building a tax-efficient ISA portfolio, Trading 212 offers a compelling platform for modern investing.

By signing up with a Trading212 referral, you get a free share worth up to £100 simply for starting your investing journey.

👉 Don’t miss out: Join Trading212 here or using the Trading 212 referral code FMStoXkl and grab your free share today.