Tide Bank Referral Code:

REFER200

Get £200 FREE when signing up for Tide using Tide referral code: REFER200. Get £75 free when you complete £100 of card transactions within 30 days and get a further £125 free when you deposit at least £5000 into a Tide instant saver account within 7 days.

If you’re a UK-based freelancer, sole trader or small business owner, choosing the right business account can save you time, money and a lot of admin headaches. Tide is one of the most popular digital business account providers in the UK – and if you’re joining as a new customer, you can usually boost your start with a Tide referral code like REFER200 to unlock a £200 welcome reward (subject to eligibility and current T&Cs).

This longform guide walks you through:

- What Tide is

- Key benefits and features

- How Tide differs from traditional banks

- Membership options and pricing

- Exactly how to sign up and use the Tide referral code REFER200

- Who Tide is best for

What Is Tide?

Tide is a UK-based, app-first business banking platform built specifically for small and micro-businesses. While people often call it “Tide bank”, it’s technically a business financial platform that provides business current accounts in partnership with licensed banks (for example, ClearBank).

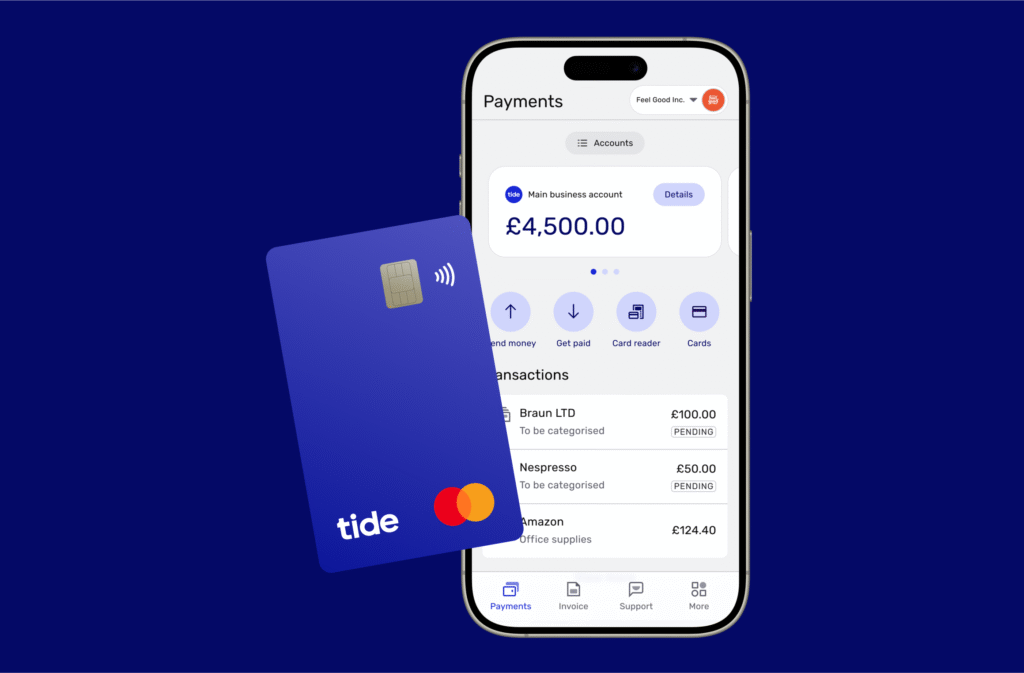

In practice, you get what feels like a modern business bank account:

- UK sort code and account number

- Business debit card (physical + virtual)

- Faster Payments, Direct Debits, standing orders

- Access via a slick mobile and web app

Tide’s mission is simple: cut the admin out of running a small business by combining banking, invoicing, expenses, accounting tools and savings into one easy-to-use platform.

Key Benefits and Features of Tide

Tide is designed from the ground up around how small businesses actually operate. Here are the core benefits and features you get when you open a Tide account (especially attractive when you join using a Tide referral code such as REFER200).

1. Fast, Fully Digital Account Opening

Forget branch appointments and paper forms.

- Apply via the Tide app or website in minutes

- Submit ID and business documents digitally

- Suitable for sole traders and limited companies

- Many applications are decided quickly after online checks

For new or busy founders, this convenience is a huge upgrade over traditional banking.

2. Business-Focused Current Account

Tide gives you a full-featured business current account:

- UK sort code and account number – get paid like any other UK business

- Business Mastercard debit card – use online, in store and abroad

- Virtual cards – create extra cards for online or separated spend

- Direct Debits and standing orders – automate regular payments

- Faster Payments and BACS – pay staff, suppliers and contractors

It behaves like a “normal” business bank account, but it lives entirely in your phone and browser.

3. Clear, Simple Pricing

Traditional business banks often charge monthly account fees and throw in complex tariff sheets. Tide takes a more transparent approach:

- Free entry-level plan with £0 monthly fee

- Usage-based fees for certain services (like some transfers or cash deposits)

- Optional paid plans (Smart, Pro, Max) that bundle more transfers, better FX rates, higher savings interest and premium support

You can start free and only upgrade once your business cash flow justifies it.

4. Powerful Mobile and Web App

Everything runs from the Tide app and online dashboard:

- Real-time balance and transaction history

- Instant notification for card transactions

- Easy search and filters to find specific payments

- Tag transactions, add notes and attach receipts

- Apple Pay / Google Pay support (where available)

Instead of having to “visit your bank”, your bank lives wherever you are.

5. Built-In Invoicing

Tide isn’t just a place where money sits; it helps you bring it in:

- Create professional invoices directly in the app

- Add your logo, business details and payment terms

- Email invoices straight to your customers

- Track which invoices are paid, pending or overdue

Because your banking and invoicing live in one place, it’s much easier to keep on top of who owes you what.

6. Expense Management and Team Cards

Once more than one person spends money in your business, control matters:

- Issue expense cards to staff or contractors

- Set custom spending limits and controls

- Track spending per card in real time

- Collect receipts and categorise expenses in the app

You keep control while still empowering your team to spend where they need to.

7. Accounting and Bookkeeping Integrations

Tide is designed to plug into your existing finance stack:

- Connects to major accounting tools like Xero, QuickBooks and Sage

- Automatically syncs transactions into your bookkeeping software

- Cuts down manual data entry and reduces errors

- Makes life easier for your accountant at year-end

You spend less time exporting CSV files and more time actually running your business.

8. VAT, Tax and Cash Flow Support

Tide helps you make better decisions about your money:

- Automatic categorisation of income and expenses

- Clear transaction history for tax preparation

- Simple views of upcoming outgoings vs available balance

- Optional invoice chasing and extra credit control tools on some plans

It’s like having a light-weight finance assistant in your pocket.

9. Savings, Pots and Instant Saver

Many business owners like separating money for tax, payroll and profit. Tide makes this easy:

- Create sub-accounts or “pots” to ring-fence money for different goals (tax, salaries, reserves)

- On eligible products, earn interest through Tide Instant Saver (rates depend on your membership plan and balance)

This makes it easier not to accidentally spend money that really belongs to HMRC or future costs.

10. Cash Deposits and ATM Access

Tide is digital-first but doesn’t ignore cash completely:

- Deposit cash at the Post Office or PayPoint (fees vary by membership plan)

- Withdraw cash from ATMs using your Tide card

If your business still handles some cash, you can manage it without needing a traditional high-street branch.

11. Security and Safeguards

With Tide you get the convenience of fintech with strong protections:

- Accounts held with regulated partners and protected/safeguarded in line with regulation

- Strong customer authentication, biometric login and security checks

- Continuous monitoring for suspicious transactions

Security is baked in, not bolted on.

12. Credit, Loans and Growth Support

As your business grows, you may need finance:

- Access to business loans and credit facilities (subject to eligibility and credit checks)

- Working capital options and growth funding via Tide’s partners

- All managed within the same ecosystem where you do your everyday banking

Instead of starting from scratch with a traditional lender, you can explore options from within Tide.

13. Multi-User Access and Permissions

You shouldn’t be sharing one login as your business expands:

- Grant access to co-founders, finance staff or bookkeepers

- Assign roles and permissions so each person only sees or does what they need to

This is cleaner and safer than sharing passwords around via email or WhatsApp.

14. Support Designed for Small Businesses

Tide’s support is geared towards people who aren’t finance experts:

- In-app chat support on all plans

- Priority chat and phone support on paid memberships

- 24/7 legal helpline included on certain plans

- Help articles written in plain language

You’re not expected to “speak bank” to get answers.

15. Extra Value Through the Tide Referral Programme

On top of all the core features, Tide runs a referral programme that rewards both new and existing customers.

- New customers can join using a Tide referral code such as REFER200 (subject to availability and T&Cs) to receive a welcome bonus.

- Existing customers can share their own referral link or code to earn rewards when people they refer open and start using a Tide account.

Used correctly, the Tide referral system can be a nice way to get paid for switching and for recommending Tide to others.

How Tide Differs from Traditional Banks

Tide’s main competitors are traditional UK high-street banks (and their business accounts). Here’s how Tide stands out – and where a conventional bank might still suit some businesses better.

Where Tide Stands Out

- Speed of onboarding

- Traditional banks often require branch visits, physical paperwork and more extensive checks.

- Tide typically allows you to apply and be up and running quickly via an app.

- Technology & automation

- Tide gives you invoicing, expense cards, integrations and savings in one place.

- Many high-street banks require separate services or third-party tools with extra friction.

- Cost and flexibility

- Tide’s Free plan has no monthly fee, ideal for new or smaller businesses.

- Paid plans are optional, not mandatory, and you can move up or down as needed.

- Built for small businesses

- Everything is aimed at freelancers, contractors, sole traders and SMEs.

- Interfaces, wording and support are designed for non-accountants.

Where Traditional Banks May Still Win

- More complex needs

- Large international operations, multiple foreign currencies or extensive cash/cheque handling may still be better served by a traditional bank with a full branch network.

- Existing relationships

- Bigger businesses sometimes prefer to keep everything at a major bank for lending, treasury and foreign exchange.

- Comfort and brand familiarity

- Some directors simply prefer a bank they recognise from the high street, particularly for larger balances or long-standing companies.

For many modern, smaller businesses, Tide offers a more flexible, cost-effective and convenient alternative – particularly when combined with a Tide referral joining bonus.

Tide Membership Options and Pricing

Tide offers four main membership plans in the UK:

- Free

- Smart

- Pro

- Max

All sit on top of the same core Tide business current account. Prices, interest rates and features can change over time, so always check Tide’s official site for the latest details, but here’s an overview based on the current structure.

1. Free – £0/month

The Free plan is the entry point for new and very small businesses.

Monthly fee

- £0

Key features and charges

- UK card transactions: free

- Foreign currency card transactions: around 2.75% FX fee

- UK bank transfers: typically £0.20 per transfer

- International bank transfers: transfer fee plus FX margin

- ATM withdrawals: charged per withdrawal

- Cash deposits: available via Post Office and PayPoint (percentage fee + minimum charge)

- Invoicing: limited number of free invoices per month

- Expense cards: charged monthly per additional card

- Instant Saver: interest available up to a set balance limit at a lower rate than paid plans

Who it suits

- Sole traders and brand-new businesses

- Those sending few transfers and handling little or no cash

- Businesses wanting to test Tide before upgrading

2. Smart – around £12.49/month

The Smart plan adds bundled transfers, better FX and more features at an accessible price.

Monthly fee

- Around £12.49

Key upgrades vs Free

- A set number of free UK transfers per month (e.g. 25)

- 0% FX fee on foreign card transactions (a big upgrade if you spend abroad)

- Lower fees on international transfers compared with Free

- Cheaper cash deposits at the Post Office

- At least one additional expense card included

- Another business account included

- Higher Instant Saver interest rate and higher balance cap

- Priority support and access to a 24/7 legal helpline

Who it suits

- Small but active businesses making regular transfers

- Companies that spend abroad or online in foreign currencies

- Businesses starting to build a small team and needing one or two extra cards

3. Pro – around £24.99/month

The Pro plan is designed for growing businesses with higher transaction volumes.

Monthly fee

- Around £24.99

Key upgrades vs Smart

- Unlimited free UK transfers

- International transfers with no extra transfer fee beyond a small FX margin

- Extra expense cards included

- Multiple additional business accounts included

- Higher Instant Saver rates and higher tiers of interest on larger balances

- Unlimited invoicing

- Tide’s own accounting tools included

- Improved rewards and partner offers

- Priority chat and phone support plus 24/7 legal helpline

Who it suits

- Businesses making lots of transfers to staff, suppliers and contractors

- Companies holding larger cash balances and wanting better interest

- Teams needing more cards and better automation

4. Max – around £69.99/month

Max is Tide’s top tier for established SMEs.

Monthly fee

- Around £69.99

Key upgrades vs Pro

- All the benefits of Pro plus:

- Most generous Instant Saver interest rates and highest balance tiers

- More additional business accounts and more free expense cards

- Enhanced member rewards and cashback on eligible card spending

- Advanced admin tools (e.g. invoice and bill management extras) included

- Payroll software included

- Highest-priority support with dedicated assistance and priority callbacks, including weekends

Who it suits

- Established SMEs with large transaction volumes

- Companies running multiple brands/entities under one umbrella

- Teams with more complex finance operations and higher balances

Moving Between Plans

Tide makes upgrading and downgrading straightforward:

- Upgrade instantly from inside the app or web dashboard

- Charges are usually pro-rated when you change plans mid-month

- You can move up as your business grows and step down if your needs reduce

This flexibility means you can start on Free, use a Tide referral code like REFER200 to grab a welcome bonus, and then upgrade later when the extra features will pay for themselves.

How to Sign Up and Use the Tide Referral Code REFER200

Now let’s bring it all together: how to actually open your Tide account and make sure you don’t miss out on the Tide referral bonus via REFER200.

Step-by-Step Sign-Up

- Download the Tide app or visit the website

- Choose “Open a business account”.

- Select your business type

- Sole trader, limited company, partnership, etc.

- Enter your personal and business details

- Name, address, date of birth

- Business name, type, registered address, Companies House number (if applicable)

- Provide ID and verification documents

- Usually a photo/scan of a passport or driving licence

- Sometimes proof of address and/or business documentation

- Enter your membership choice

- Start on Free or choose Smart, Pro or Max if you already know what you need.

- Remember you can change later.

- Add your Tide referral code

- When you see a field labelled “Referral code”, “Promo code” or similar, enter REFER200.

- Double-check spelling and capitalisation before you submit.

- Complete the checks

- Tide will run its onboarding and compliance checks.

- If approved, you get your sort code, account number and card details.

- Meet the qualifying criteria for the referral bonus

- Once your account is open, use it as your main business account.

- Typically, you’ll need to meet minimum card spend or deposit conditions within a defined period (for example, card spending of at least a set amount in the first 30 days).

- Make sure you understand which transactions are considered “eligible spend”.

- Receive your reward

- After meeting the conditions and any waiting period, your Tide referral reward from REFER200 is usually paid into your Tide account as a credit or cashback.

Typical Eligibility and T&Cs for REFER200

The exact terms for REFER200 can vary over time and between campaigns, so always read the latest offer page carefully. However, the structure usually follows a similar pattern:

- New customer only

- You must be opening a Tide business current account for the first time.

- Existing or previous Tide business account holders are normally excluded.

- Location and age

- Director or account holder must be at least 18.

- Business must be UK-based and meet Tide’s eligibility criteria.

- Use of the code

- You must enter REFER200 during sign-up in the dedicated promo/referral field.

- In some campaigns, there may be a short window after account opening to add a code, but you shouldn’t rely on this – enter it at sign-up wherever possible.

- Qualifying activity

- You must meet specific conditions such as:

- Making a minimum amount of eligible card spend within a set number of days, and/or

- Maintaining a certain minimum balance or deposit level for a period.

- Certain transaction types may not count as eligible spend (for example: internal transfers, ATM withdrawals, fees, chargebacks, some wallet top-ups, etc.).

- You must meet specific conditions such as:

- Reward amount and payment

- The promotion can offer up to £200 in rewards, depending on the exact campaign.

- The reward is typically paid as account credit or cashback.

- Payment is usually made within a set number of weeks after you complete the qualifying activity.

- One reward per business

- Generally, each eligible business can receive the REFER200 reward only once.

- Multiple sign-ups for essentially the same business can be declined.

- Misuse and changes

- Tide can withhold or reclaim rewards if it suspects abuse, fraud or breach of terms.

- The Tide referral offer, code, reward amount and conditions can be changed or withdrawn at any time, so always rely on the latest official T&Cs.

Important: Because promotions change, you should always read the current terms on Tide’s official website or in the app before applying. This article is a guide, not legal or financial advice.

Who Is Tide Best For?

Tide is especially strong for:

- Freelancers and sole traders

- Simple structure, low-cost entry, very quick sign-up.

- Startups and micro-businesses

- No monthly fee on the Free plan, scalable features as you grow.

- Growing SMEs

- Pro and Max plans with unlimited transfers, better interest rates, more cards and high-level automation.

- Digital-first businesses

- E-commerce, agencies, consultants and online service providers benefit most from the app-first design.

You might consider a traditional bank instead or in addition if:

- You handle large volumes of cash and cheques

- You need extensive multi-currency and international banking facilities

- You prefer a long-standing relationship with a high-street bank for complex corporate finance needs

Final Thoughts: Is Tide Right for You? And Using the Tide Referral Code

Tide delivers a modern, app-driven business banking experience with features that directly target the real-world pain points of small businesses: slow onboarding, clunky interfaces, hidden fees, and too much admin.

To recap:

- You get quick, digital account opening

- A full-featured business current account and card

- Time-saving tools: invoicing, expenses, integrations, savings and more

- Flexible membership plans from Free to Max

- And you can boost your start with a Tide referral code like REFER200, unlocking a welcome reward if you meet the eligibility criteria

If you’re a UK-based sole trader, freelancer or small business owner looking for a straightforward, powerful and scalable way to manage your business money, Tide is absolutely worth serious consideration. And if you do decide to join, don’t forget to enter Tide referral code: REFER200 during sign-up so you don’t miss out on the referral bonus available at the time you apply.