TaxScouts Referral Code

Click the link above or here to activate our special TaxScouts referral offer and get 10% off your first service from TaxScouts.

🧾 What is TaxScouts?

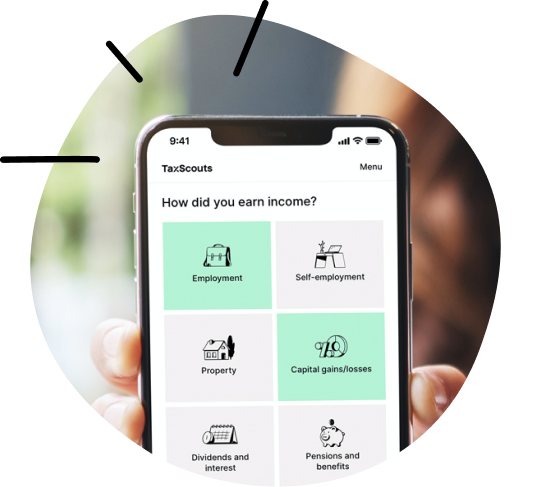

TaxScouts is a UK-based online tax service designed to simplify the often complex and stressful process of filing tax returns. Acquired by Taxfix Group in July 2024, TaxScouts connects customers directly with accredited UK accountants, streamlining the tax return process through user-friendly technology.

TaxScouts primarily serves individuals required to complete Self Assessment tax returns, such as freelancers, landlords, investors (including cryptocurrency and share investors), high earners, expats, or anyone with untaxed income sources. Their approach replaces complicated forms and jargon with simple, understandable language and efficient online processes.

Their ethos: cut out long form‑filling and jargon, reduce admin for the accountants, and deliver peace of mind for individuals needing to file tax returns

🔍 What Services Are Offered?

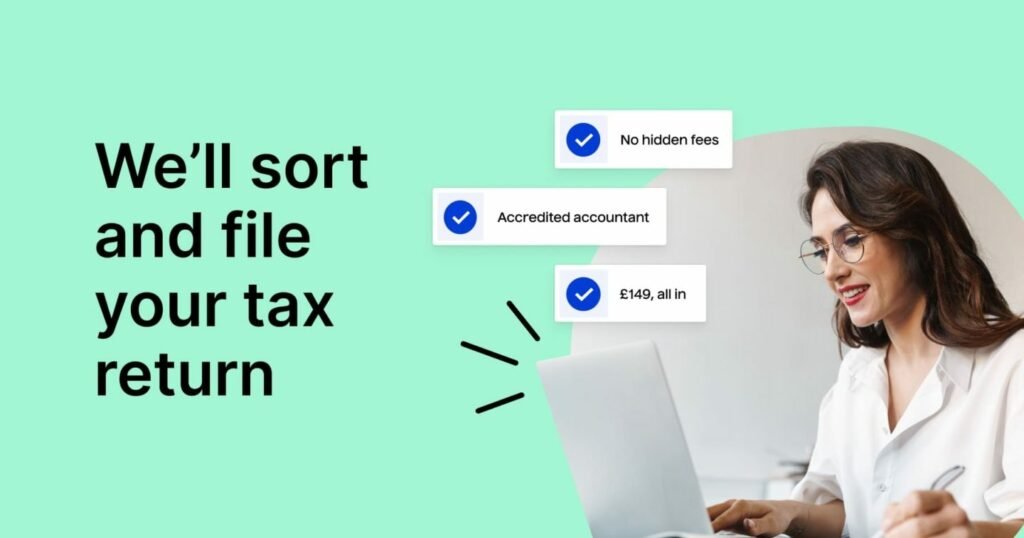

Their core service, the Self Assessment Tax Return, is priced at a fixed fee of £169 (including VAT). Once signed up, customers upload relevant documents like their P60, income details, and expenses. A UK-based accountant then prepares and files the tax return directly with HMRC, typically within 48 hours of receiving all necessary information. The service includes unlimited revisions and full accountant support, ensuring accuracy and peace of mind.

For those needing tailored guidance, TaxScouts offers a One-off Tax Advice Consultation for £139. This service provides a 30-minute consultation, either via phone or video call, with a follow-up written summary of advice. Additionally, the Tax Bundle combines both the tax return filing and advice consultation for a discounted rate of £249.

TaxScouts offers three main services:

- Self Assessment Tax Return – For filing your personal tax return with HMRC, handled by a UK-based accredited accountant. Upload your documents, answer simple questions, and they’ll prepare and file the return—often within 48 hours once everything’s submitted

- One-off Tax Advice Consultation – A 30‑minute phone or video consultation with an accredited accountant, followed by a written summary. Great for getting questions answered or planning. Advice is delivered clearly and concisely

- Tax Bundle – Combines both services (tax return filing + advice consultation) at a discounted fixed price. You get a dedicated accountant, a tax return prepped and filed, and tailored advice

Additionally, they offer free bookkeeping tools. These let you invoice clients, track expenses/income, upload receipts via AI extraction, and link bank accounts. The tools are always free—even without purchasing a paid service

They also support limited company tax returns for small businesses at transparent pricing and with the same streamlined, online workflow

💸 Pricing Summary

| Service | Price (inc. VAT) | What’s Included |

|---|---|---|

| Self Assessment tax return | £169 | Licensed accountant handles entire return, claims reliefs, files it, unlimited changes/support |

| One-off tax advice | £139 | 30‑minute consultation + written summary |

| Tax bundle (return + advice) | £249 | Both services combined at a discount, matched with the same accountant |

Note: the tax advice service is restricted during December–January (tax season) to topics related to Self Assessment, CGT, and foreign income only. Full advice resumes from February

✅ How to Sign Up

Signing up to TaxScouts is straightforward and takes just minutes. Users first create an account and answer a few basic questions about their financial situation. They then upload necessary documentation directly through the platform. After paying the one-off fee for the selected service, users are matched with an accredited accountant who handles the entire process. Customers review the final return or advice before submission, ensuring transparency and clarity. Remember to sign up using out Taxscout referral code here to get 10% off your first order.

- Start by creating an account on TaxScouts’ website. (use our taxscout referral link)

- Answer a few simple questions about why you need a tax return or advice. This only takes a couple of minutes

- Upload your documents, such as P60, P45, income/expense details, receipts, etc. Some cases allow HMRC data import if you’ve authorised access

- Pay the fixed one‑off fee for the service you choose. There’s no subscription or hidden charges

- Get matched with an accredited accountant, who begins working on your case. You can communicate via the platform or by email.

- Review and approve your tax return or advice summary. After approval, if you’ve chosen the return service, they file your submission with HMRC on your behalf

If you need to register for Self Assessment (UTR), your accountant can help you to set this up free of charge. That can take around 10 working days for HMRC to issue the UTR

Once your return is filed, you’ll either receive a refund or need to pay HMRC directly via their portal; TaxScouts doesn’t collect tax payments directly but can guide you through the process

🧩 Who Is TaxScouts Suited For?

This service is designed for:

- People filing a Self Assessment tax return: self‑employed, freelancers, landlords, investors (crypto, shares, property), high earners, expats, and anyone with untaxed income. It’s especially useful for first‑time filers or those with complex income types (e.g. crypto, foreign income)

- Users who want to avoid the frustrations of HMRC’s portal and prefer a streamlined, jargon‑free experience with support and accountability

- Users who only need professional advice, rather than a full return.

TaxScouts is often cheaper than typical local accountant quotes, which may cost several hundred plus VAT just to file a return; reviews mention quotations of £350+ VAT being outperformed by TaxScouts’ £169 price

TrustPilot ratings average ~4.8/5 based on thousands of reviews, indicating high user satisfaction

Using a TaxScouts Referral Code

If you’re new to TaxScouts, you can use the referral code FAISAL315 to receive a 10% discount on your chosen service or click here to directly activate the offer. To use the referral code, simply enter FAISAL315 at checkout when selecting and paying for your service. This code provides a straightforward saving on your first transaction.

Terms and Conditions for Using Referral Code FAISAL315:

- The referral code is only valid for first-time users of TaxScouts.

- The code must be entered at checkout to be eligible for the discount.

- The discount applies exclusively to the service fee (Self Assessment Tax Return, One-off Tax Advice, or the Tax Bundle).

- It cannot be combined with any other promotional offer or discount.

- The referral discount has no cash value and is non-transferable.

- TaxScouts reserves the right to modify or cancel the referral discount offer at any time without prior notice.

Overall, TaxScouts stands out due to its affordability, transparency, fast turnaround times, and reliable support from professional UK accountants, making it an ideal choice for those seeking a simplified and stress-free tax filing experience.

🧠 Why Choose TaxScouts?

- A fixed-price, clear-fee structure—no surprises.

- Fast turnaround: many returns filed within 48 hours from completion of your inputs

- Full support from a vetted, HMRC‑regulated UK accountant.

- Unlimited revisions and clarifications.

- Free bookkeeping tools whether or not you pay for a service

- Part of a larger European tax platform (Taxfix), so they have scale and established tech while keeping service UK-focused

📝 Summary

TaxScouts offers a professional yet affordable solution to UK Self Assessment filing and general tax advice. With a simple online process and rapid service, it’s especially ideal for those who want clarity, speed, and confidence their taxes are done correctly. Pricing is straightforward: £169 for a tax return, £139 for advice, or £249 for both bundled together—VAT included and no hidden fees.

If you’d like guidance on whether the tax return service is better for you than the advice-only option, feel free to ask!

TaxScouts also provides free bookkeeping tools, enabling users to manage invoices, track expenses, and integrate bank accounts seamlessly, even without purchasing any additional services. The convenience and affordability of TaxScouts often make it a more attractive option compared to traditional accountants, who typically charge significantly higher fees for similar services.

Overall, TaxScouts stands out due to its transparent fixed pricing, quick turnaround times, easy-to-use platform, and reliable support from accredited UK accountants, making it ideal for individuals seeking a stress-free tax experience.

Remember to sign up using our TaxScout referral code here to save 10%.