Monzo Referral

Use this Monzo referral link: https://join.monzo.com/c/c2x1h3l and you could receive £10, £20, or £50 in bonus when you make your first card transaction within 30 days of signing up.

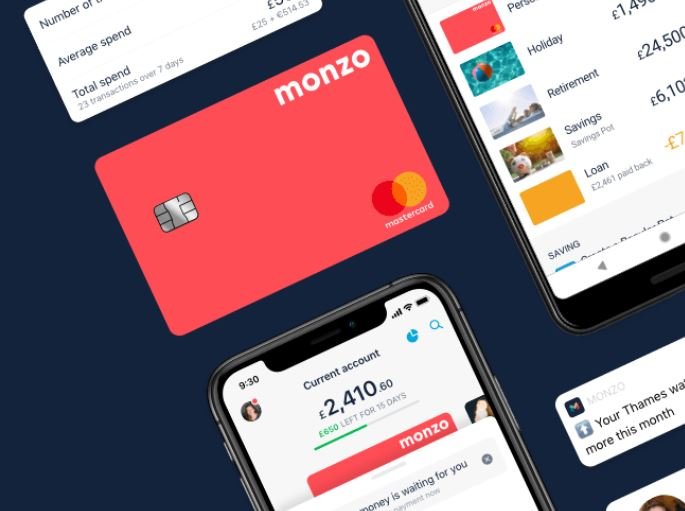

Monzo Bank UK: A Digital Banking Revolution

How Monzo Started and Its Rise in the UK

Monzo emerged in 2015, originally known as Mondo, founded by Tom Blomfield and team—many of whom previously worked at Starling Bank. Its crowdfunding launch was historic: £1 million was raised in just 96 seconds via Crowdcube.

In April 2017, Monzo received a full UK banking licence, transitioning from a prepaid model to a fully-fledged current account provider. By 2025, it had amassed over 9.3 million users, reached profitability, and posted a net profit of £94.5 million on £1.2 billion in revenue. This rapid growth reshaped what banking could look like in the digital age.

From instant spending notifications to clever savings “pots” and fee-free spending abroad, Monzo has redefined what a modern bank should look like. And if you’re new to Monzo, there’s never been a better time to join. With this exclusive Monzo referral link:

👉 Join Monzo here and get a £10, £20, or £50 bonus when you make your first card transaction within 30 days.

How the Monzo Referral Bonus Works

- After signing up via the link, both you and the referrer become eligible for a “mystery” bonus of £10 (94% chance), £20 (5% chance), or £50 (1% chance).

- Eligibility requires making your first card transaction within 30 days of entering your phone number via the referral link.

- “Card transaction” can be completed immediately using the virtual card (via Apple/Google Pay) or the physical debit card once it’s delivered.

Step-by-Step: Claim Your Bonus via Monzo Referral Link

- Tap the Monzo referral link: https://join.monzo.com/c/c2x1h3l

- Enter your UK mobile number, which starts the 30-day countdown.

- Download the Monzo app, complete registration, and verify your ID.

- Load your account with any amount of money.

- Use your Monzo virtual or physical card to complete your first transaction within 30 days.

- Shortly after the transaction, your bonus (£10, £20, or £50) will be credited to your account—and your referrer gets the same amount.

Important Notes & Terms

- The referral reward is randomized, with most people receiving £10, so the exact amount isn’t guaranteed.

- If the referred user doesn’t complete the transaction within 30 days, neither person is eligible for the bonus.

- Monzo monitors for suspicious or abusive behavior—any suspected gaming of the system may result in a revoked bonus.

- The bonus offer can change or end at any time; always check the status in the Monzo referral hub (🎁 icon in-app).

- This referral is valid for new Monzo customers only who have never had a Monzo Personal or Business account.

Key Features & Benefits of Using Monzo

Real-Time Insights & Smart Money Management

- Instant Notifications: Get immediate alerts whenever you spend or receive money—no more surprises.

- Spending Pots: Organize your money into “pots” for goals like bills, holidays, or daily spending.

- Auto Round-Ups: Round each transaction to the nearest pound and automatically save the spare change.

- Advanced Categorization & Insights: View spending trends by category, get alerts for direct debit changes, and see real-time budgeting analytics

Seamless Banking & Global Convenience

- Fee-Free Spending Abroad: Use your card globally with no fees. Free ATM withdrawals up to £200 per month outside the EEA; higher allowances on paid plans.

- Aggregated View: Link your other bank accounts and credit cards to see all finances in one place.

Transparency & Protection

- 24/7 In-App Customer Support: Chat with real Monzo staff at any time for support.

- FSCS Protection: Monzo balances (up to £85,000) are safeguarded by the UK’s deposit protection scheme.

- Fraud Security Tools: Authenticate large transactions via trusted contacts, secret QR codes, and location verification.

Flexible Service Plans

Monzo offers tiered account plans to suit different needs:

| Plan | Features |

|---|---|

| Free | Core banking, real-time notifications, pots, budgeting tools, FSCS protection. |

| Extra (£3/m) | Adds virtual cards, connected banking, custom categories, and auto spreadsheets. |

| Perks (£7/m) | Includes Extra features plus 3.5% AER on pots, Railcard, Greggs treat, Uber One membership. |

| Max (£17/m) | All Perks benefits plus travel & phone insurance, breakdown cover, better savings rates. |

Extended Products for Personal & Business

- Monzo Flex: A buy-now-pay-later feature evolved into a full credit card.

- Personal Loans & Overdrafts: Available within the app, depending on eligibility.

- Business Banking: Lite, Pro (£9/m), and Team (£25/m) plans for sole traders and limited companies—includes invoicing, card controls, and integrations.

- Monzo Pensions (SIPP): Consolidate and manage pensions in-app, with Self-Invested Personal Pension options.

- Contents Insurance: A simple coverage solution for renters launched in 2025.

Step-by-Step Signing Up with Monzo: Remember To Use Our Monzo referrel Link : HERE

Opening a Monzo account is quick and mobile-first. Here’s the streamlined process:

- Download the Monzo App

Search for “Monzo” on the App Store or Google Play. - Enter Personal Details

Provide your full name, UK address, phone number, and email. Expect questions about occupation and how you’ll use the account. - Verify Your Identity

Submit a photo ID (passport, driving licence*, national ID, or biometric permit) and a quick selfie video. - Choose Your Monzo Plan

After verification, select from Free, Extra, Perks, or Max based on your preferences. - Activate Your Card

Your Monzo debit card arrives via post within a few days. Just follow the in-app instructions to activate. - Start Using Your Account

You can begin spending, saving, setting up Pots, linking other accounts, or using Monzo’s extended services.

Why Monzo Continues to Lead UK Digital Banking

- Disruptive Growth: From crowdfunding roots to reaching 12 million users and profitability in 2025.

- Customer-Centric Design: Innovative tools like Pots, spending categories, and real-time insights make budgeting intuitive and engaging.

- Versatile Ecosystem: Catering to personal, business, savings, spending, and insurance needs—Monzo adapts to life’s stages.

- Competitive Edge: Key benefits like fee-free global transactions, strong analytics, app-based adaptability, and customer service continue to put Monzo ahead of traditional banks.

UK Bank Comparison: Monzo vs. Other Providers

Monzo: What Sets It Apart

Monzo stands as one of the most popular UK neobanks, with 9.3 million users, £1.2 billion revenue, and £94.5 million net profit in 2025. Tailored for the mobile-first generation, Monzo offers:

- Instant spend tracking, real-time notifications, and smart Pots for savings

- Fee-free foreign spending, including ATM withdrawals abroad up to set limits.

- Fully regulated with FSCS protection up to £85k, plus in-app customer support.

Monzo vs Other Top UK Digital Banks

Starling

- Similar instant alerts and Pots (called Spaces).

- May handle cash deposits more flexibly than Monzo.

Revolut

- Stronger for multi-currency use, trading, and crypto services.

- Offers high savings rates (4–5% AER), while Monzo’s savings sit at around 3.6–4.1% AER.

- Monzo is simpler and better known for transparency and over-sight.

Chase UK

- Powerful cashback offers (e.g., 1%) and high Trustpilot scores, now ranking #1 in FCA customer satisfaction.

- Monzo and Starling follow closely, reflecting growing trust in challenger banks.

Monzo vs Traditional High-Street Banks (Barclays, HSBC, etc.)

Mobile Tools & Digital Convenience

- Monzo prioritizes real-time tracking and budgeting tools unavailable in many legacy apps.

- Traditional banks are catching up. HSBC’s upcoming app overhaul, for example, will incorporate pots and spending categories—directly inspired by challenger innovations.

Customer Satisfaction & Innovation

- Challenger banks, including Monzo, often score higher in satisfaction surveys across digital, overdraft, and overall service.

- Traditional banks lag but offer stability and depth of services.

Trust & Resilience

- Legacy banks benefit from established infrastructures and deposits safeguards—giving them a reliability edge for some users.

- Fintechs face scrutiny on financial controls and stability. Monzo and competitors are adapting to tighter regulations

Quick Feature Comparison Table

| Feature | Monzo (Digital Bank) | Starling | Revolut | Traditional Banks (HSBC, Barclays, etc.) |

|---|---|---|---|---|

| Mobile App Quality | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐–⭐⭐⭐ (improving) |

| Real-Time Spend Alerts | Yes | Yes | Yes | Limited or delayed |

| Savings Pot Tools | Smart Pots | Spaces | Vaults | Often not available |

| Fee-Free Spending Abroad | Yes | Yes | Limited (depends) | Foreign fees apply |

| Savings Rates | 3.6–4.1% AER | Competitive | 4–5% AER (higher) | Typically low |

| Reward Perks | Paid tiers (Perks/Max) | Focused rewards | Some cashback & trading | Packaged accounts with insurance etc. |

| App Support | 24/7 Chat | 24/7 Chat | Support varies | Branch or limited digital support |

| Regulatory Trust | FSCS Protected (£85k) | FSCS Protected | Varies by account type | FSCS Protected |

- Monzo is ideal if you value real-time visibility, budgeting tools, and mobile convenience.

- Starling offers similar benefits, with better options for some cash transactions.

- Revolut is best for global finance savvy users prioritizing crypto and multi-currency.

- Traditional banks offer depth, stability, and comprehensive services but are only now catching up digitally.

Expanding Monzo’s Product Range

Monzo has steadily extended its offerings beyond basic banking:

- Monzo Flex — A buy-now-pay-later (BNPL) feature, later evolving into a full credit card offering

- Personal Loans & Overdrafts — Made available to effectively served users following the current account rollout

- Business Banking — Tailored for sole traders and SMBs, complete with tax-saving Pots and invoicing tools

- Shared Pensions (SIPP) — Launched in mid-2024, enabling users to consolidate and manage pensions from within the app

- Contents Insurance — In 2025, Monzo added renters’ contents coverage, filling a major protection gap in the UK market

Reception, Trust, and Controversies

Reception

Monzo is frequently cited for its user-friendly design, transparency, and value proposition — especially by younger, tech-savvy users and travelers. Its savings tools and analytics have been widely adopted for budgeting and goals like holiday spending.

Challenges

There have been security and public relations setbacks. Monzo once exposed 480,000 customer PINs due to a logging error. Additionally, a BBC Watchdog investigation highlighted frustrations with delayed account closures. In 2025, the FCA fined Monzo £21 million for lax anti-fraud measures—even allowing obviously invalid addresses like “Buckingham Palace”.

Conclusion

Monzo has carved a clear path from its 2015 fintech roots to becoming a mainstream UK bank of over 9 million users. Its app-first banking model, user focus, and commitment to new product categories have redefined what banking can be—responsive, transparent, and mobile-native.

Whether you’re a frequent traveler, a savings enthusiast, or someone tired of outdated banking, Monzo offers compelling tools that make money management smarter and simpler.

And with the Monzo referral offer, there’s no better time to try it. Use the link below, sign up in minutes, and claim your bonus after your first purchase.