FreeTrade Free Share Offer

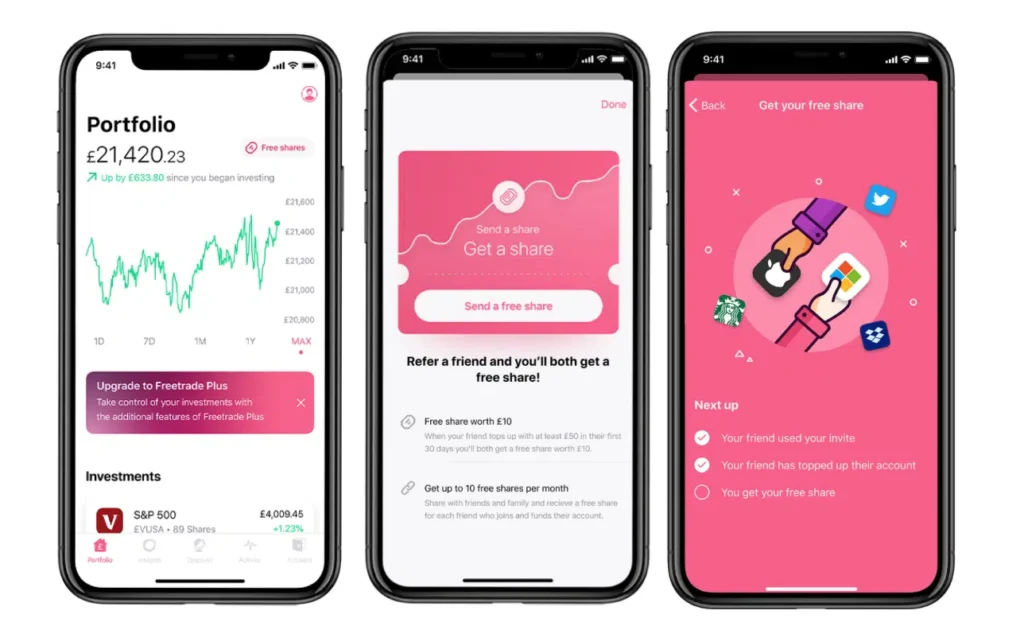

Click the Freetrade referral link above or here and complete the registration process and deposit £50 into your account to get up to £250 in Freetrade free shares. Full details on how to sign up and the terms and conditions (T&Cs) are provided below.

Introduction: A New Way to Invest in the UK

For decades, investing in shares was something reserved for professionals or those willing to pay hefty broker fees. Traditional UK platforms often charged £5–£12 per trade, alongside account fees, making it costly for beginners.

Enter Freetrade—a UK fintech that has transformed the landscape with commission-free trading, a mobile-first platform, and the ability to invest from as little as £2. Since its launch in 2016, Freetrade has grown to over 1 million users, making it one of the UK’s most popular investment apps.

And the best part? If you sign up using a Freetrade referral link, you’ll receive a free share worth up to £250.

What is Freetrade?

Freetrade is an app-based investment platform that allows users to buy and sell shares, ETFs, and investment trusts without paying traditional dealing fees. It’s authorised and regulated by the Financial Conduct Authority (FCA) and has quickly become one of the UK’s most popular investing apps, with over 1 million registered users.

Key Features at a Glance

- Commission-Free Trades – Buy and sell UK and US shares with no dealing fees.

- Fractional Shares – Invest from as little as £2 by owning a fraction of a share.

- Wide Market Access – Thousands of UK, US, and European companies plus ETFs.

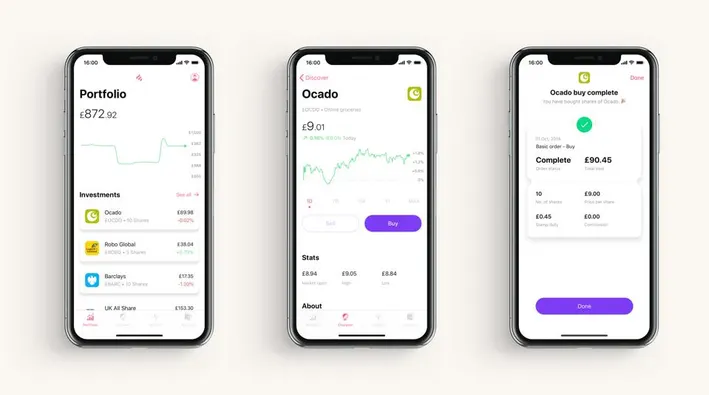

- Mobile-First Design – Simple, user-friendly app available on iOS and Android.

- FCA-Regulated – With FSCS protection up to £85,000 on eligible accounts.

How to Sign Up for Freetrade & Get A Free Share Using Our Freetrade referral

Getting started with Freetrade is simple:

- Use the Freetrade Referral Link

Sign up through this link to be eligible for the free share:

👉 https://magic.freetrade.io/join/faisal/4953c3fc - Download the App

Available on both iOS and Android. - Register and Verify

Provide ID documents and complete standard security checks. If you plan to trade US stocks, fill in a W-8BEN form. - Fund Your Account

Deposit at least £50 (net) into your account within 30 days. - Claim Your Free Share

Your free share—worth between £10 and £100, or up to £250 during promotions—will appear in your portfolio within 7–10 days.

How the Freetrade Free Share Bonus Works

- Eligibility – Must sign up with a referral link, complete verification, and deposit £50+.

- Value – Shares are chosen at random, usually valued £10–£25, but can go as high as £250.

- Delivery – Added to your General Investment Account (GIA) after 7–10 days.

- Withdrawal Rules – If sold, the proceeds must remain in your account for 180 days.

💡 Pro Tip: Many users hold their free share for long-term growth—why sell if the company has potential to grow further?

What Freetrade Free Share Can You Get?

The Freetrade referral code gives you a random share from a pool of popular UK and US companies, ETFs, or investment trusts.

- 80% of free shares are worth £10–£25

- Some lucky users get shares worth £50, £100, or even £250

These are real shares – you can hold them, sell them, or reinvest them. If you sell, the cash proceeds must stay in your account for 180 days before withdrawal.

Types of Freetrade Accounts

Freetrade offers several account types, depending on your goals:

- General Investment Account (GIA)

- Standard account for buying and selling shares.

- No tax advantages, but great for starting out.

- Stocks & Shares ISA

- Tax-efficient account with a £20,000 annual allowance.

- Dividends and capital gains are tax-free.

- £4.99/month fee.

- Freetrade SIPP (Self-Invested Personal Pension)

- Retirement account with tax relief on contributions.

- Government tops up 20–45% depending on your income tax rate.

- £9.99/month fee.

- Freetrade Plus

- Premium account (£11.99/month).

- Unlocks advanced order types (limit orders, stop losses), a wider range of stocks, and 3% interest on uninvested cash (up to £4,000).

Costs and Fees

While basic share dealing is free, Freetrade has a transparent and fair pricing model:

- Free Trading – Unlimited commission-free trades on standard shares and ETFs.

- FX Fee – 0.39% on US and international share purchases (still cheaper than traditional brokers).

- Premium Accounts – £11.99/month for Freetrade Plus.

- No Hidden Charges – No inactivity fees, withdrawal fees, or account closure charges.

Freetrade’s Investment Universe

Freetrade gives users access to:

- UK Shares – FTSE 100, FTSE 250, and AIM-listed companies.

- US Shares – Thousands of companies including Apple, Tesla, and Amazon.

- ETFs – Low-cost funds covering global indices, sectors, and themes.

- Investment Trusts – A variety of managed funds for long-term growth.

The app continues to expand its range to meet customer demand, with new assets added regularly.

Why Investors Choose Freetrade

1. Accessibility

No jargon, no hidden fees—just a clean and simple platform designed to welcome first-time investors.

2. Affordability

Commission-free trading and fractional shares make investing possible for everyone, even with small amounts.

3. Transparency

Freetrade prides itself on being clear with customers. Its business model is easy to understand, with no hidden surprises.

4. Safety & Regulation

As an FCA-regulated firm, client funds are held securely with FSCS protection.

Limitations to Consider

Like any platform, Freetrade has areas to improve:

- No Desktop Platform – It’s entirely mobile-based, which may not suit advanced traders.

- Limited Research Tools – Great for beginners, but experienced investors may find research and charting options limited.

- International Markets – Focused on UK and US; coverage of global exchanges is still expanding.

Freetrade vs Other UK Platforms

How does Freetrade stack up against traditional UK brokers?

| Broker | Dealing Fee per Trade | Account Fee | Strengths |

|---|---|---|---|

| Freetrade | £0 | From £0 | Commission-free, easy to use, fractional shares |

| Hargreaves Lansdown | £11.95 | 0.45% | Excellent research tools, desktop platform |

| AJ Bell Youinvest | £9.95 | 0.25% | Wide investment range, strong reputation |

| Trading 212 | £0 | £0 | Free trading, CFDs & forex available |

| Revolut | Limited free trades | Subscription tiers | Good for casual traders but not built for investing long-term |

✅ Verdict: Freetrade is ideal for beginners and long-term investors who value simplicity and low costs, while more advanced traders might prefer Hargreaves Lansdown or AJ Bell for research tools and broader markets.

Who is Freetrade For?

- Beginner Investors who want a simple and cost-effective way to start building wealth.

- Young Professionals looking to grow long-term savings through ISAs and pensions.

- Casual Traders who prefer a user-friendly mobile app without the clutter of advanced tools.

Conclusion: The Future of Investing in the UK

Freetrade has democratised investing in the UK by offering a platform that is accessible, affordable, and transparent. With commission-free trades, fractional shares, and tax-efficient account options, it’s an excellent choice for anyone looking to take their first steps into the world of investing.

While it may lack some advanced features, its simplicity is its greatest strength. For long-term investors who want to own shares and funds without paying hefty fees, Freetrade represents the future of investing in the UK.

If you’re ready to start investing without high fees, Freetrade is one of the most beginner-friendly options in the UK. And with the Freetrade referral code, you’ll get a free share worth up to £250 just for joining and funding your account.

👉 Sign up today using this exclusive Freetrade referral link:

https://magic.freetrade.io/join/faisal/4953c3fc

Don’t miss your chance to start investing and grab your free share.