Curve Referral Code:

NRV67J6E

Looking for a Curve promo code? You’ve found it.

Sign up to Curve today with the referral code NRV67J6E or use this link:

👉 https://www.curve.com/signup/#NRV67J6E

Make your first purchase of £10 or more within 14 days and you’ll get £5 free Curve Cash credited to your account.

Curve UK: One Card to Rule Them All

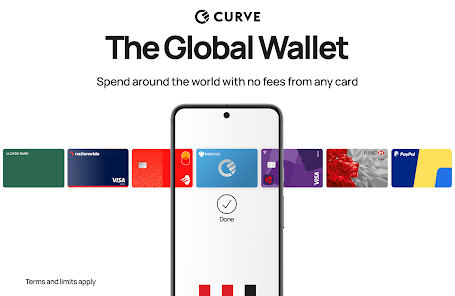

Curve is a fintech “wallet card” that lets you link multiple existing debit and credit cards into one physical and digital card. The idea is: instead of carrying several cards, you use one Curve card/app, then choose which underlying card to charge each purchase to — and even switch that choice after the fact. There are tiers, extra rewards, and travel-/overseas-use features. It’s particularly appealing to people who travel, use many cards, or want to simplify how they pay.

Curve brings all your debit and credit cards together into one. Instead of carrying a wallet stuffed with multiple cards, Curve allows you to link them all in its app, then spend using just a single Curve card. Behind the scenes, Curve routes each transaction to whichever linked card you’ve selected.

But Curve isn’t just about convenience. It also adds powerful features such as “Go Back in Time”, which lets you move a payment from one card to another even after it’s been made, and fee-free spending abroad up to certain limits.

And thanks to the Curve referral scheme, new users can get £5 free cash just for signing up and making a purchase.

One of the easiest ways to try Curve is through their referral programme. By using a Curve referral code when you sign up, you’ll earn a bonus for simply making your first purchase.

👉 Use this Curve promo link: https://www.curve.com/signup/#NRV67J6E

Or enter the code Curve referral code NRV67J6E during signup.

How Curve Works

- You download the Curve app (iOS or Android), register, verify identity, set up the physical card, and link your existing Visa & Mastercard cards (debit or credit).

- When you spend using Curve, the transaction is routed through a card you’ve selected in the app (or later you can “Go Back in Time” to reassign to a different linked card).

- There’s both a physical Curve card and digital options (Apple Pay, Google Pay, etc.).

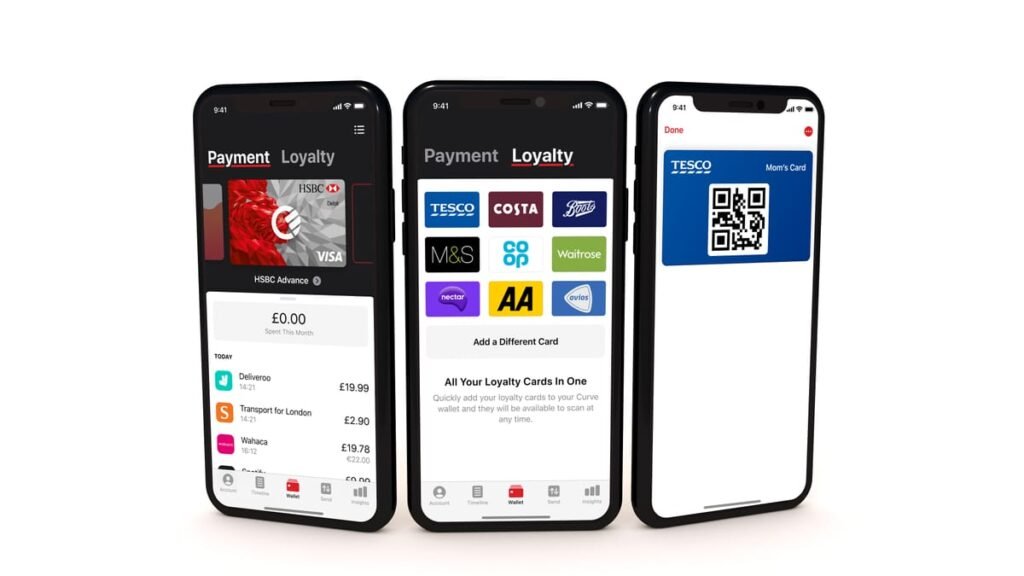

- You can also manage loyalty cards, backup cards, and get notifications/insights of spending across all your linked cards in one place.

Key Features & Benefits

- One Card for All Your Cards

— You can link multiple debit and credit cards into the Curve app, and then use a single Curve card or digital wallet (Apple Pay, Google Pay, etc.) instead of carrying them all.

— In the app, you choose which underlying card to charge when making a payment; and if needed, you can change which card was used later (with “Go Back in Time”) so you can correct accidental uses.

— This simplifies your wallet and gives you flexibility, especially for managing rewards, credit cards, and budgeting. - “Go Back in Time” Feature

— One of Curve’s best-known tools. It lets you retrospectively change which linked card paid for a transaction. So if you used the wrong card (e.g. a card with no rewards or higher fees), you can switch it later.

— The allowed period to make such a change depends on your membership tier. Some tiers offer several weeks (or even up to 120 days) to move transactions around. - Backup / “Anti-Embarrassment” Mode

— You can set a “backup card” in case your chosen payment source doesn’t work (e.g. insufficient balance, issues with credit card).

— If your primary card fails when making a payment, Curve can automatically use the backup so your transaction doesn’t decline.

— Once funds are available or you want, you can use Go Back in Time to reassign it to your intended card. - Foreign Spending & Currency Conversion

— Curve offers relatively favourable foreign exchange (FX) rates compared to many traditional bank cards.

— Certain tiers allow a monthly fee-free limit for overseas spending. Past that limit, fees may apply depending on your plan.

— Also helps avoid or reduce hidden FX fees that some credit/debit cards charge. - ATM Withdrawals Abroad

— Free ATM withdrawals abroad (up to certain amount) depending on your tier. After the free limit, withdrawals may incur fees.

— Limits vary. For example, free withdrawal caps or free number of withdrawals can differ by plan. - Cashback / Rewards “Curve Cash”

— On higher tiers (Black, Metal etc.), you can select certain retailers where you earn cashback when using Curve.

— Even on free / lower tiers, there are occasional “Rewards” offers. These can stack on top of underlying card rewards. - Notifications, Spending Insights & Security

— Real-time notifications for every transaction help you track spending in the moment.

— You get visibility over all your linked cards, so you can see where your money is going without switching between banking apps.

— You can freeze/unfreeze your Curve card via the app if it’s lost or you suspect fraud.

— All transactions are hidden behind the Curve card number; your underlying cards’ details aren’t exposed to merchants. - Tiered Plans with Increasing Benefits

— Curve has multiple subscription tiers. The free tier offers core functionality, with fewer perks. Paid tiers unlock more benefits, such as: higher “Go Back in Time” windows, greater free FX/ATM-withdrawal allowances, more option slots for cashback retailers, priority support, etc.

— If you travel frequently, spend abroad often, or want advanced features, the paid tiers can pay for themselves. If your usage is light and mostly domestic, the free or lower-cost plan might suffice. - Live Protection & Open Banking Integrations

— Curve UK Limited is regulated and protected; it offers monitoring for fraud, live notifications, and protection of customer purchases (up to certain amounts).

— Using open banking and linked accounts, Curve can give you a consolidated view of your linked cards’ balances, improving your financial visibility without having to flip between multiple apps.

Curve Referral Scheme – Get £5 Free with Code NRV67J6E

What’s the Offer?

- New customers who sign up to Curve using the referral link https://www.curve.com/signup/#NRV67J6E or enter the curve promo code NRV67J6E in the app can receive £5 in Curve Cash.

- To qualify for the bonus, you must make one transaction of £10 or more using the Curve card (physical or digital) within 14 days of signup.

How to Use the Curve Referral Code

- Download the Curve app (iOS or Android).

- During signup, either use the link https://www.curve.com/signup/#NRV67J6E or enter Curve promo code NRV67J6E in the referral/promo code box.

- Complete all verification steps (identity, address, etc.) and activate your Curve card.

- Make a purchase of £10 or more with your Curve card within 14 days.

- After that transaction is confirmed, the £5 Curve Cash bonus will be credited to your account.

Key Terms & Conditions to Watch

- The offer is for new users only; people who have had a Curve account before may not be eligible.

- The purchase must be with your Curve card (either physical or via digital wallet) to count.

- The “transaction of £10 or more” must happen within 14 days of signup or card activation.

- Some purchases may be excluded (e.g. refunds, internal transfers, or certain categories/merchants), depending on Curve’s rules.

- The £5 bonus is credited as Curve Cash Points or equivalent in the app, which you can spend through Curve (but typically not withdraw as cash).

Benefits of Doing This

- You get free money simply for trying the service, with minimal effort.

- Using Curve gets you access to its features: “Go Back in Time”, consolidated spending across multiple linked cards, foreign transaction savings, etc.

- The bonus adds incentive to use the Curve card sooner rather than later, so you can begin to take advantage of its perks right away.

Things to Double-Check

- Make sure Curve hasn’t updated the promotion (sometimes promo offers change or expire).

- Confirm the transaction requirement; some offers require more than one spend, or specific merchant types.

- Be aware whether there are minimum spend exclusions, or whether certain card types (digital vs physical) are accepted.

The Curve Plans / Tiers (and What They Cost)

Curve offers several tiers (plans) in the UK, each with different monthly fees and features. As of mid-2025, they look like this:

| Plan Name | Monthly Fee | Key Benefits / Limits |

|---|---|---|

| Curve Pay (basic) | Free (physical card delivery + some fees) | Basic allowance for free FX spending abroad, limited free ATM withdrawals abroad, fewer Smart Rules, “Go Back in Time” window is shortest. |

| Curve Pay X | ~ £5.99 | More FX allowance, more card slots to link, more frequent free ATM withdrawals abroad, more “Go Back in Time” days, some extra perks. |

| Curve Pay Pro | ~ £9.99 | Further increased allowances, more retailer cashback slots, etc. |

| Curve Pay Pro+ | ~ £17.99 | Highest tier: large allowances abroad for FX, large free ATM withdrawals, most “Go Back in Time” days, full range of perks including more cashback retailers, possibly insurance or travel benefits. |

Note: Physical card delivery may cost on basic plans, replacement cards may carry charges; limits apply for free FX/withdrawals etc. The details of what’s allowed fee-free vs what incurs charges depend heavily on which plan you are on.

Fees, Limits & Hidden Costs

While Curve has many advantages, it is not completely free. Here are the fees and “watch-outs”:

- Currency Conversion Fees (outside of your free allowances) — after your free FX spending limit is exceeded in a rolling period, you pay fees (percentage of amount).

- ATM Withdrawal Fees abroad — free up to a limit, then charge (often % of amount or a flat fee).

- Subscription / Plan Fees for paid tiers. If you’ll benefit enough to justify those fees depends on your spending abroad and usage.

- “Weekend FX surcharge” — sometimes additional charges for purchases or ATM use in non-local currency during weekends or public holidays.

- Replacement card fees (if you lose the physical card).

- Limits on how many “Go Back in Time” changes you can do, and how far back in time, depending on plan.

Use Cases: Who Gets the Most from Curve

Curve suits certain people especially well:

- Travellers: You spend overseas regularly, want to avoid hit from FX fees, want fee-free ATM withdrawals abroad.

- Multiple card users: You have several credit or debit cards and want to simplify carrying them, but still get the rewards or benefits of those cards.

- People who forget which card to use: “Go Back in Time” lets you correct mistakes (e.g. used a card that didn’t give cashback but should have).

- Budgeters: Consolidated view of spending; “Smart Rules” help route spending appropriately.

- Occasional cashback enthusiasts: With paid tiers, the cashback from partner retailers via Curve can be useful.

Limitations & What to Watch Out For

Curve is not perfect for everyone. Some drawbacks:

- You lose Section 75 credit card protection in many cases when using a linked credit card via Curve (since you’re using Curve as the merchant-facing entity rather than your credit card company). This may matter for big purchases.

- American Express is not supported in many cases.

- If your usage is mostly domestic and not much abroad, the free FX/ATM withdrawal limits may be low, so you might hit fees.

- The monthly fee on higher tiers can be hard to justify unless you use the perks heavily.

- Some features are plan-locked, meaning free plan users may not get much of the “premium” value.

- Customer service experiences vary, especially for claims or disallowed transactions.

Comparison vs Alternatives

Curve competes with digital banking apps, wallets, travel cards and some fintechs like Wise, Revolut, or certain credit cards with travel benefits. Key differences:

- Many cards charge FX fees for overseas spending; Curve may avoid or reduce those for free under certain allowances.

- Unlike some travel cards, Curve consolidates all your cards, giving flexibility.

- Wise offers excellent multi-currency features, but may not let you swap payment source retrospectively as Curve does.

- Premium travel credit/debit cards may offer insurance & lounge access which Curve’s paid tiers may attempt to match—but often with less generous cover.

Is Curve Worth It?

The verdict depends heavily on your spending habits. If you:

- Spend regularly abroad (travel, foreign online retailers, etc.),

- Use more than one bank/card and want to simplify,

- Make purchases that can benefit from “Go Back in Time” or routing to a rewards credit card,

then Curve can be a powerful tool that not only simplifies your wallet, but also saves you money on fees, foreign exchange, and perhaps increases your rewards overall.

But if your spending is mostly UK-based, rarely abroad, and you already have a credit card with good perks, maybe the free plan or even just sticking with existing cards is sufficient.

Conclusion

Curve is a powerful “one card, many functions” fintech solution. It offers a neat way to manage multiple cards, simplify spending, reduce overseas charges, and access rewards. But it’s not unambiguously “good for everyone”—the benefits depend a lot on how and where you spend.

If you travel, shop with foreign merchants, want fewer cards, or sometimes slip up on which card to use, Curve may be worth trying. If you decide to go ahead, make sure you pick the plan that matches your usage so that fees don’t outweigh the perks.

Curve is more than just another card—it’s a financial tool that gives you control, convenience, and savings. With features like Go Back in Time, consolidated spending insights, cashback, and travel perks, it’s designed to simplify your finances while adding flexibility.

And with the Curve referral offer, there’s no better time to try it. Sign up with Curve promo code NRV67J6E or via the referral link, make your first £10+ purchase, and you’ll get £5 free Curve Cash to spend.

A smarter wallet, fewer fees, and free money to get started—Curve is an easy win for anyone who shops, spends, or travels.

Curve Referral FAQs

1. How do I claim the Curve referral bonus?

Sign up using referral code NRV67J6E or the referral link, make a purchase of £10+ within 14 days, and Curve will credit £5 Curve Cash to your account.

2. When will I get my £5 Curve referral bonus?

The £5 is usually added to your Curve Cash balance shortly after your first qualifying transaction has cleared. This can take a few working days.

3. Where can I spend my Curve referral bonus?

Your £5 referral bonus is credited as Curve Cash, which can be spent at almost any retailer that accepts Curve.

4. Do existing Curve users qualify for the referral code?

No, the Curve referral offer is only for brand-new users who have never signed up before.

5. What counts as a qualifying £10 spend?

Any standard purchase of £10 or more made using your Curve card (physical or digital) counts. Withdrawals, refunds, or internal transfers may not qualify.

6. Can I combine the Curve referral with other promotions?

Yes, if Curve is running other offers (such as cashback boosts), you can benefit from both as long as you meet the requirements.

Start Now and Claim Your Free £5

Use this Curve referral today and get rewarded:

👉 Sign up with code NRV67J6E